Why central bank gold buying signals a shift every serious investor should understand

Central banks don’t just set monetary policy — they set the tone for global reserves. Their moves reveal what the world’s largest institutions trust when it comes to preserving value across generations. In an era of rising tensions, record debts, and waning confidence in fiat currencies, those moves matter more than ever. It’s time to follow the good money.

Today, the trend is unmistakable. According to the latest World Gold Council survey, a record 95% of central banks expect to increase their gold reserves in the next 12 months — up sharply from 81% just a year ago. Meanwhile, 76% anticipate building their allocations over the next five-years, and nearly three quarters intend to reduce their dollar holdings.

This isn’t trend chasing. It’s a recalibration.

Over the past three years, central banks have accumulated more than 1,000 tonnes of gold annually — more than double the average rate of the prior decade. In the first quarter of 2025, central bank purchases surged to 244 tonnes — roughly 24% above the five‑year average — underscoring the urgency of this shift.

In a fragmented and unpredictable global order, gold has reemerged as the cornerstone of financial resilience — an antidote to rising tensions, rising debts, and waning trust in fiat currency.

Why This Matters

If institutions responsible for preserving national wealth are making this shift, it begs a straightforward question for everyone else: why aren’t more individual and corporate investors doing the same?

For generations, gold has served as a bedrock for long‑term stability. Its unique characteristics — no counterparty risk, no yield dependency, and global liquidity — have made it the ultimate reserve across eras and borders. Today, as traditional “safe” investments can no longer be taken for granted, gold is reclaiming its role as a core safeguard.

Those who recognize this shift early have the greatest opportunity to secure their position.

How to Act on This Shift

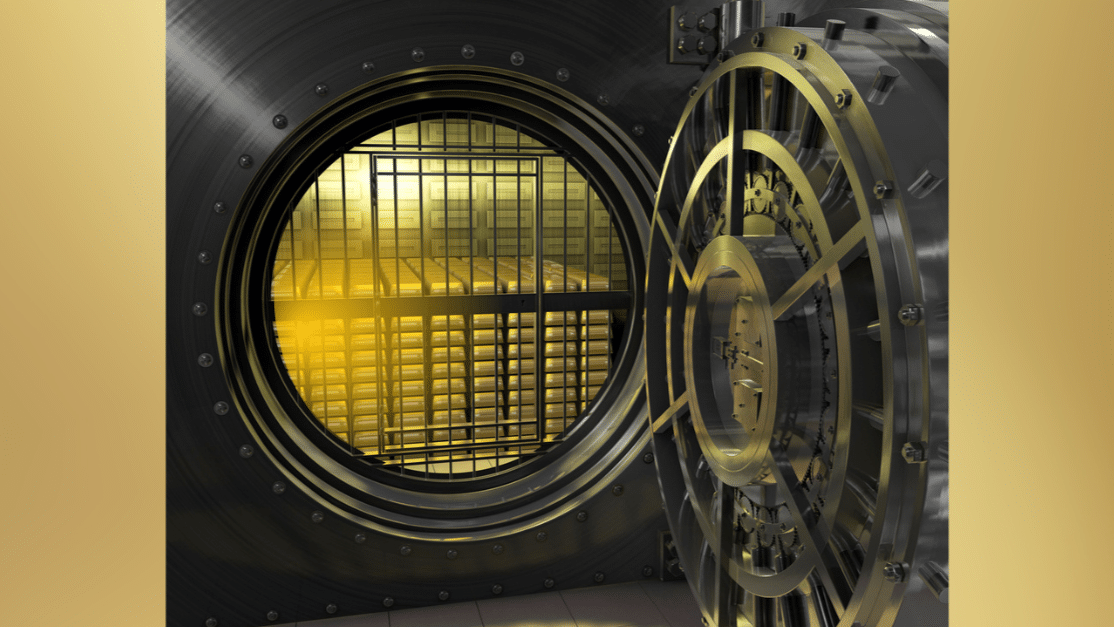

If the world’s largest institutions are reshaping their reserves, it’s worth asking if your portfolio should do the same. At Strategic Gold, we help individual and corporate clients adopt the disciplines that guide central bank activity. We deliver direct, fully allocated, and securely held physical gold, audited and insured to institutional standards.

In a world where institutions move first, aligning your approach with theirs can be the key to long‑term financial strength. If you’re ready to build a reserve‑grade foundation for your own portfolio Strategic Gold is here to help. Let’s talk about how direct ownership of physical gold can secure your future, and position you to thrive in the world that’s emerging.

This article is for informational and educational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not constitute a recommendation to buy or sell any asset. Always consult with a qualified financial advisor before making investment decisions.